Different Regions Pay Differently.

Can You Take Their Payments?

One Technology

Covers payments in virtually any form around the world

Customized Checkout

Reporting and Analytics

Multi-Currency Solutions

High Conversion Rates

Risk

Management

Management

Seamless Integration

How It Works

Card Payments - From Low Risk To High Risk

150+ Alternative Payment Methods

Cross -Border Payment Solutions

Fair FX Conversion

Diversified Payments

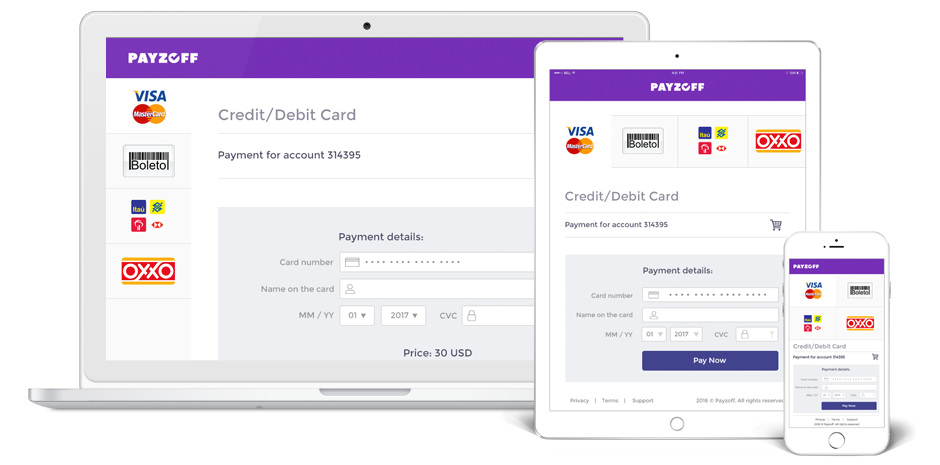

We made sure your customers will be able to pay for their desired product or service via any device you can imagine.